How to Find a Sunglass Manufacturer in China

To find a reliable sunglass manufacturer in China, you must execute a four-phase strategy. First, identify the correct manufacturing hub (e.g., Wenzhou for volume, Shenzhen for luxury) for your product. Second, use B2B sites and trade shows to build a supplier pipeline. Third, rigorously vet candidates through samples and audits. Finally, secure the partnership with a China-specific NNN agreement and a detailed manufacturing contract to protect your IP and quality standards.

Phase 1: Strategic Blueprinting & Ecosystem Analysis

Your advantage begins by aligning your business model with the right manufacturing ecosystem. China’s eyewear landscape has seven concentrated regional clusters, each offering distinct advantages based on your product, volume, and quality needs.

Mapping China’s Eyewear Production Hubs

You must align your business with the manufacturing hub that best fits your product’s quality, cost, and technology requirements.

| Hub Location | Primary Specialization | Key Characteristics & Output | Ideal For |

| Wenzhou | High-Volume & Trend-Driven | World’s largest sunglasses cluster; excels in acetate and metal frames at competitive prices. | Brands needing cost-efficiency and multiple designs. |

| Taizhou | Mass-Scale & Cost-Efficient | Strong in plastic frames; produces 40% of China’s eyewear exports; factories handle >5M pairs annually. | Brands requiring rapid scaling and aggressive pricing. |

| Shenzhen | Premium & Luxury | China’s high-end epicenter; produces 70% of global premium frames (titanium, high-grade acetate). | Established brands launching premium, complex designs. |

| Danyang | Optical Lenses | “Optical lens capital”; produces 50% of global output; excels in polarized, photochromic, and UV400 lenses. | Brands needing seamless frame and lens integration. |

| Emerging Hubs | Niche & Diversified | Xiamen (lenses), Yingtan (cost-alternative), Chongqing (growing capacity in metal, acetate, TR90). | Brands seeking niche opportunities or supply chain diversification. |

Pro Tips: Wenzhou manufacturers typically offer MOQs of 1,000-2,000 pieces per order, with 300-500 pieces per color. This is ideal for testing multiple designs while maintaining cost control. Shenzhen factories require higher MOQs but provide superior customization.

Decoding Supplier Capabilities

Understanding the operational models of different supplier types directly impacts your product quality, cost, and supply chain reliability.

OEM vs. ODM vs. Private Label Models

Your choice of partnership model depends entirely on your in-house design and R&D resources.

| Model | Description | Best For |

| OEM (Original Equipment Mfr.) | You provide 100% of the technical specifications and designs. The factory builds to your exact specs. | Maximum control over the final product. |

| ODM (Original Design Mfr.) | The manufacturer provides design input or modifies their existing product lines for you. | Reducing R&D costs and speeding time-to-market. |

| Private Label | You select a pre-existing, market-proven design and apply your own branding. | The fastest market entry with minimal investment. |

Factory vs. Trading Company: A Critical Distinction

Trading companies often pose as manufacturers but are intermediaries that add 10-20% margin to your costs. Direct factory relationships provide transparency, control, and better pricing.

Key Metric: You must verify factory status. Demand business license documentation, photos of the factory floor, and a detailed list of production equipment. Legitimate factories provide specific employee counts and production line configurations.

Vetting Material Expertise: Plastics to Premium Metals

A supplier’s material expertise dictates the quality, durability, and feel of your final product.

| Material | Key Characteristics | What to Verify in a Supplier |

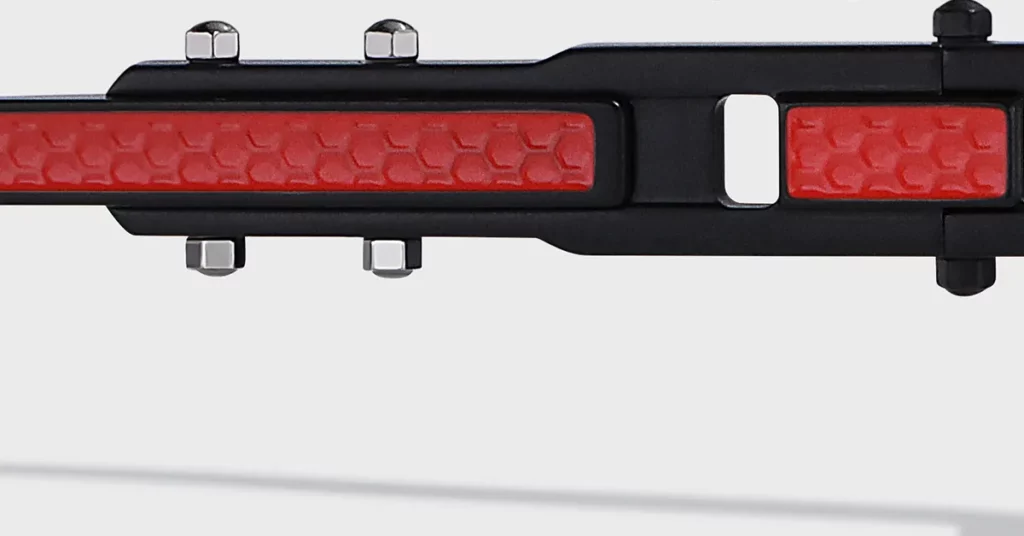

| TR90 | Thermoplastic offering superior durability, impact resistance, and lightweight comfort (50% lighter than acetate). | Expertise in injection molding; ability to manage heat resistance up to 350°C. |

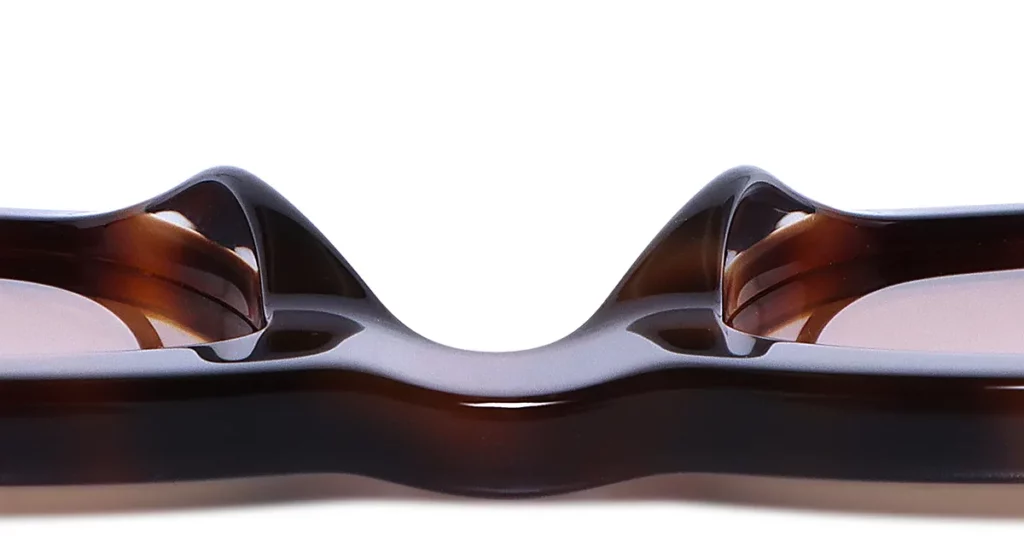

| Acetate | Premium material with superior color depth, pattern possibilities, and hypoallergenic properties. | Sourcing from top-tier producers like Mazzucchelli; controlled production environment. |

| Titanium | Lightweight, corrosion-resistant metal for exceptionally durable, high-end frames. | Specialized equipment and technical expertise for welding and finishing; strict quality control. |

| Eco-Friendly | Wood, bio-plastics, and other sustainable materials. | Sourcing from certified suppliers (e.g., FSC for wood); proof of material composition. |

Assessing Advanced Lens Technologies

Lens quality is a non-negotiable aspect of your product’s performance and safety.

- UV400 Protection: This is the minimum standard, blocking 99-100% of UVA/UVB radiation. Demand test reports confirming compliance with EN ISO 12312-1.

- Polarization: Quality polarized lenses reduce glare by 98-99%. Verify polarization efficiency across the supplier’s range.

- Coatings: Evaluate offerings like anti-reflective, anti-scratch, and hydrophobic coatings.

- Impact Resistance: For sports or safety applications, confirm expertise with materials like polycarbonate or Trivex.

Critical Warning: You must verify polarization quality with your own eyes during factory visits. Inferior polarized lenses can cause visual distortion and will lead to customer complaints.

Phase 2: Building Your Pipeline

A multi-channel discovery strategy is essential to build a robust list of potential manufacturing partners.

Systemizing Your B2B Marketplace Search

Digital platforms offer access to thousands of suppliers, but you must apply systematic filters to find true manufacturing partners.

| Platform | Strengths & Focus | Actionable Framework |

| Alibaba | Largest supplier discovery platform. | Search with specific keywords (“acetate sunglasses manufacturer”). Filter by location, Trade Assurance, and years in business. |

| Global Sources | Pre-screened suppliers with verified business credentials. | Focus on “Verified” suppliers to reduce initial due diligence workload. |

| Made-in-China | Comprehensive profiles with export history data. | Use the platform’s rating system and transaction records to gauge reliability. |

Decoding Supplier Badges for Risk Assessment

Use supplier verification badges as an initial filter, not a final decision. Create a scoring matrix weighting verification status (30%), years in business (25%), transaction history (25%), and response quality (20%) to rank prospects.

- “Trade Assurance” (Alibaba): Indicates a supplier’s willingness to stand behind quality commitments via payment protection.

- “Gold Supplier” (Alibaba): Requires annual verification of business licenses.

- “Verified” (Global Sources): A third-party has verified the supplier’s business registration, facility, and operational capacity.

Identifying Red Flags: Trading Companies & Low Bids

Best Practice: To expose trading companies posing as factories, request a live video call showing their production lines in operation. Pay close attention to the equipment, worker activities, and facility organization. A genuine factory can demonstrate this easily. Unusually low pricing is another red flag that often indicates poor materials or a trading company’s hidden markup.

Maximizing Trade Fair ROI

Trade shows offer direct access to manufacturers and market intelligence. Prioritize shows that align with your target market and product tier.

| Trade Show | Location | Key Benefit |

| Hong Kong Optical Fair | Hong Kong | Comprehensive access to over 800 Asian manufacturers and international brands. |

| MIDO | Milan, Italy | Premier European show where top Chinese manufacturers exhibit their premium export capabilities. |

| Wenzhou Int’l Optics Fair | Wenzhou, China | Direct access to China’s largest eyewear manufacturing cluster, from components to finished goods. |

| Silmo | Paris, France | A global hub for style and innovation, attracting high-end manufacturers. |

Pre-Show Due Diligence Checklist

- Research Exhibitors: 4-6 weeks pre-show, identify target suppliers based on their product catalogs and certifications.

- Schedule Meetings: Contact suppliers in advance to book dedicated time for detailed discussions.

- Prepare an Evaluation Form: Create a standardized checklist covering capacity, quality systems (ISO 9001), and customization options.

- Bring Comparison Samples: Use competitor products to facilitate direct, tangible conversations about quality and finishing.

Leveraging On-the-Ground Expertise

Professional sourcing support provides market knowledge and cultural understanding that improve negotiation outcomes.

The Case for Sourcing Agents

A qualified sourcing agent gives you immediate access to a pre-vetted supplier network, reducing your discovery timeline from months to weeks. Their understanding of Chinese business culture prevents misunderstandings that can derail partnerships.

Critical Warning: You must verify an agent’s credentials. Demand client references and examples of their quality control reports before sharing any proprietary designs.

Evaluating Sourcing Partner Capabilities

An effective sourcing partner maintains a documented supplier evaluation process, including facility audits and quality system assessments. Their quality control services must include pre-production, in-line, and pre-shipment inspections to reduce your defect rates.

Tapping into Wholesale Markets

For direct product assessment and supplier interaction, physical markets like those in Yiwu and Shenzhen offer unique advantages. Yiwu provides access to thousands of suppliers with lower MOQs, while Shenzhen’s markets are focused on premium manufacturers and advanced designs.

Phase 3: The Strategic Vetting Framework

This is where you move from a longlist to a confirmed partner through rigorous due diligence.

Executing Rigorous Technical & QA Due Diligence

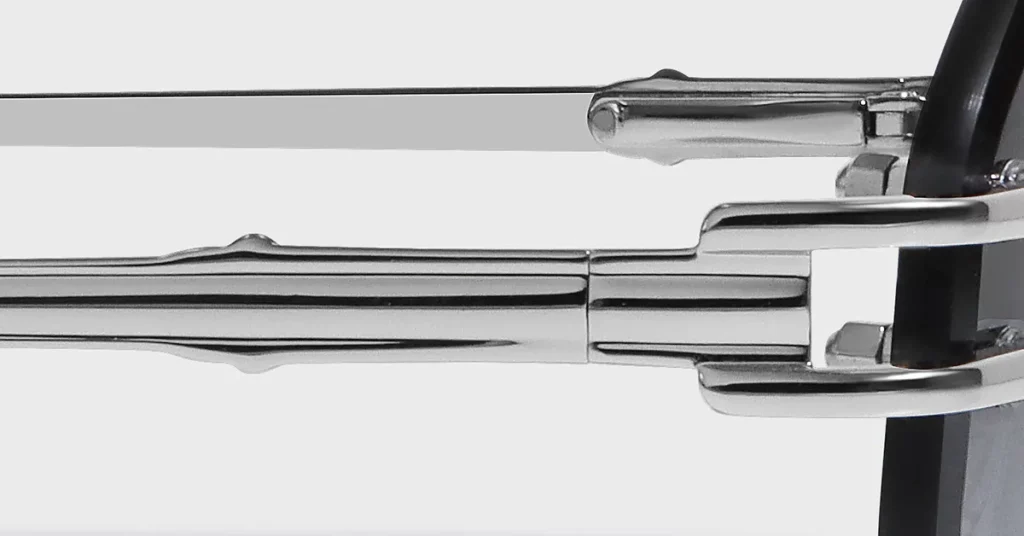

Mandate and evaluate product samples to validate material quality, construction integrity, and finishing precision. A quality sample demonstrates a supplier’s capabilities far better than any sales pitch. Inspect hinge mechanisms, temple flexibility, and frame alignment with extreme prejudice.

Requiring a Detailed Tech Pack Breakdown

A comprehensive tech pack includes all material specs, Pantone color numbers, dimensional tolerances, and quality criteria. A supplier’s ability to work from a detailed tech pack is a key indicator of their professionalism. Confirm their ability to source specific materials and achieve your required logo placement and durability.

Verifying Quality & Social Compliance Audits

You must verify a factory’s quality management system.

- ISO 9001:2015: This certification indicates established quality management processes that reduce defects. Request the current certificate and audit report.

- BSCI (Business Social Compliance Initiative): This audit verifies ethical labor practices and safe working conditions. It is a frequent requirement for major retail partners.

Establishing International Compliance

Product compliance is a non-negotiable requirement for market entry.

U.S. Market: FDA & Drop Ball Test Compliance

The FDA classifies non-prescription sunglasses as Class I medical devices. Always conduct this verification.

- FDA Registration: The factory must be registered with the FDA.

- Drop Ball Test: Each shipment requires a certificate confirming compliance with 21 CFR 801.410. This test involves dropping a 5/8-inch steel ball from 50 inches onto each lens.

Key Metric: Verify a supplier’s testing capabilities and certificate generation process before production begins. Missing documentation will cause costly customs delays and shipment rejection.

EU Market: CE Marking & REACH Compliance

- CE Marking: Sunglasses are Personal Protective Equipment (PPE) in the EU and require a CE mark. The supplier must maintain a technical file and a declaration of conformity.

- REACH: This regulation restricts harmful substances like lead and cadmium. Demand material safety documentation confirming compliance.

Demand Existing Test Reports (ISO, AS/NZS)

Prioritize suppliers who can already provide existing test reports for key international standards like EN ISO 12312-1 (global) or AS/NZS 1067 (Australia/New Zealand). This pre-qualifies their capabilities and reduces your compliance timeline.

Commercial & Operational Viability Assessments

Analyze MOQs and payment structures to align with your financial projections. Standard MOQs are 300-500 pieces per model. A common payment structure is a 30% deposit and a 70% balance upon shipment.

The Imperative of Factory Audits

You must conduct an on-site or third-party factory audit before signing any contract. An audit validates the production capacity, equipment condition, and quality systems that are impossible to assess remotely.

Defining a Clear Quality Control Plan

Execute a multi-stage inspection plan to protect your investment.

- Pre-Production Inspection: Verify materials and production setup against your approved sample.

- In-Line Inspection: Identify issues early in the production run when corrections are still possible.

- Final Pre-Shipment Inspection: Perform a final quality check, including packaging and documentation review, before the goods leave the factory.

Phase 4: Securing Your Partnership

This final phase is about implementing legal frameworks to protect your brand and formalize the relationship.

Implementing a Bulletproof IP Strategy

Protecting your intellectual property in China requires China-specific legal agreements.

The Critical Role of an NNN Agreement

A standard NDA is insufficient. Execute a China-specific NNN (Non-Disclosure, Non-Use, Non-Circumvention) agreement before sharing any designs. This agreement, drafted to be enforceable in Chinese courts, prevents a supplier from disclosing your designs, using them for other clients, or selling directly to your customers.

Proactively Register Trademarks & Patents

Best Practice: China operates on a “first-to-file” system. You must register your trademarks and design patents in China before you begin manufacturing. This is the single most effective step to prevent infringement. Design patents protect your product’s appearance, while trademarks protect your brand name.

Structuring Your Manufacturing Agreement

Your supply agreement must clearly define all terms to prevent future disputes.

Defining Tooling & Mold Ownership

Custom frame molds can cost $400-$1,200. The agreement must state that you own the mold upon payment.

For Example: Specify that tooling ownership transfers to your company upon final payment and that the supplier may only use the mold for your authorized production runs. Document the mold’s maintenance responsibilities and useful life.

Specifying Packaging & Labeling Rules

Define all packaging requirements to ensure compliance with end-market regulations. For U.S. imports, a “Made in China” mark is mandatory. For the EU, CE marking placement is critical. These details prevent costly customs issues.

Establishing Communication Protocols

Establish clear protocols for communication, production reporting, and dispute resolution. Define response timeframes and escalation processes to ensure transparency and accountability throughout the partnership.

Conclusion

This four-phase framework transforms finding a sunglass manufacturer in China from a gamble into a systematic process. By mapping ecosystems, vetting suppliers, and executing bulletproof legal agreements, you position your brand for sustainable growth. Your success depends not on finding the cheapest price, but on identifying a true partner whose capabilities and quality systems align with your brand.

Frequently Asked Questions

1. What is a realistic cost for a new custom frame mold?

Custom frame molds typically cost between $400 and $1,200, depending on complexity. Payment is almost always 100% upfront before production of the mold begins. The buyer owns the mold upon completion.

2. How do I prevent my design from being sold to others?

The most effective step is to register your design patents in China before sharing any specs. China’s first-to-file system gives legal rights to the first applicant. This, combined with a strong NNN agreement, creates the best possible IP protection.

3. What if a supplier can’t provide a recent test report?

Demand that the supplier commissions testing from an accredited lab before you commit to production. A quality partner will see this as a necessary investment. Never proceed without current compliance documentation.

4. How do I effectively audit a factory’s social compliance?

Engage a professional third-party audit service like BSCI, SEDEX, or SA8000. These firms use standardized frameworks to provide objective reports on labor practices, safety, and environmental compliance. Make ongoing compliance a contractual requirement.

5. What certifications should I ask for with eco-friendly materials?

Request certifications like Forest Stewardship Council (FSC) for wood, Global Recycled Standard (GRS) for recycled content, and ASTM D6400 or EN 13432 for compostable bio-plastics. Be wary of vague claims without third-party verification.