For Luxury Brands: How to Increase Production Volume While Preserving Brand Exclusivity

To increase production volume while preserving exclusivity, you must implement a dual strategy. First, architect scarcity using tactical releases like limited editions and capsule collections while protecting iconic products with tiered pricing. Second, vet manufacturing partners on their ability to execute low-volume pilot runs, maintain quality control at scale, and provide a fully traceable, ethical supply chain.

The Strategic Imperative: Mastering the Paradox of Scaling Luxury

Deconstructing the Core Conflict: Why Scaling Threatens Brand Equity

Scaling production is not merely an operational challenge; it is an attack on the psychological pillars of luxury.

- The Dilution Effect: You must recognize that increased availability erodes perceived rarity. This is because scarcity signals status, while oversupply communicates commoditization, which directly undermines the desirability that justifies your premium.

- The Pricing Power Problem: Your premium pricing relies on a perception of exclusivity. When your products flood the market, consumers question the price justification, which forces margin compression and a devalued market position.

- Risk of Alienating Core Clients: Your most valuable “very important customers” (VICs) purchase uniqueness. The assertion is that mass-market expansion alienates these buyers. This is because they seek distinction, not ubiquity. You must therefore protect your top-tier products to avoid losing the long-term revenue from your most loyal clients.

The Modern Market Context: Widespread Over-Inventory

The post-pandemic luxury market has slowed to an estimated 1–3% annual growth, with widespread over-inventory plaguing wholesale channels. This market reality demands that you fine-tune release cadences and adopt cycle-based scarcity models to sustain momentum and prevent your brand from contributing to the glut.

Redefining the Pillars of Modern Exclusivity

Exclusivity today extends beyond product limits; it is built on community, values, and access. You must leverage these intangible assets to reinforce your brand’s position.

- Beyond Price: True exclusivity is now built through community and values. The rationale is that purpose-driven clients seek alignment with brands that champion ESG commitments like sustainable materials and ethical sourcing. Your action is to integrate these values into your releases to engage this demographic and reinforce your brand ethos.

- From “Having” to “Being”: The modern luxury consumer prioritizes exclusive experiences over mere ownership. This is supported by a market shift toward curated events, VIP showings, and bespoke design consultations. You must offer these services to forge emotional bonds that drive repeat, high-margin purchases.

Differentiating Scarcity Models

You must choose a scarcity model that aligns with your brand’s core identity and commercial goals. Each model has a distinct financial and brand impact.

| Scarcity Model | Core Mechanism | Strategic Business Impact |

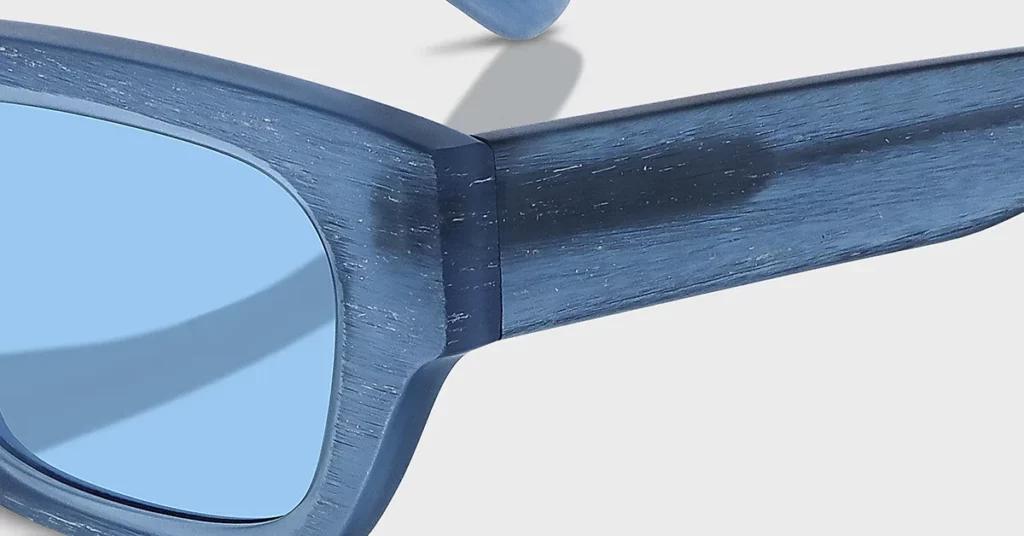

| Natural Scarcity | Based on intrinsically rare or costly raw materials, such as Japanese titanium or ethically sourced horn. | Inherently limits production output; reinforces a narrative of authenticity and heritage. |

| Tactical Scarcity | Numbered, limited-edition product runs or one-time capsule collections. | Creates powerful “hype cycles” that spike demand and media attention without increasing core volume. |

| Cyclical Scarcity | A calendar of scheduled, controlled product drops rather than a constant “always-on” inventory. | Maintains a steady state of desirability and anticipation; prevents market saturation and trains consumers. |

The Business Case for Preservation

Failing to manage this balance has severe financial consequences. Brand dilution directly cuts lifetime customer value and erodes brand equity, which can reduce your company’s valuation multiples by up to 15% over five years as perceived exclusivity declines.

The Brand-Side Playbook: Architecting Scarcity at Scale

Mastering Product, Price, and Release Strategy

- The Limited Edition and Capsule Collection Model: Use micro-drops of 20–100 units to test new designs and generate buzz. The rationale is that this creates controlled “hype cycles” that drive pre-orders and media attention. Your action is to transition successful designs into the core collection after demand is validated.

- The Tiered Product Architecture: Protect your iconic, flagship products at ultra-premium price points. This is because it preserves your brand’s aspirational peak. You can then introduce lower-tier, seasonal styles at more accessible prices to capture new customers without devaluing your core offering.

- Implementing Prestige Pricing: You must use strategic price increases as a lever to signal quality and manage demand. Annual increases of 5–8% reinforce the perception of quality. Best Practice: Combine price adjustments with tangible material upgrades, like 18k-gold hinges, to transparently justify the premium.

Case Study: Automotive and Horology Models for Eyewear

Luxury automotive and watch brands offer proven scarcity models that you can adapt directly to eyewear.

| Industry Leader | Scarcity Mechanism | Direct Eyewear Application |

| Ferrari | Annual Production Cap: Legally caps car production at a set number (e.g., 10,000 units) to guarantee rarity. | Cap your core, iconic frame styles to a fixed number of units per year to create verifiable scarcity. |

| Rolex | Relationship-Based Waitlist: Access to high-demand models is granted based on client purchase history and relationships. | Offer bespoke frames or early access to new collections via an invitation-only waitlist for top-tier clients. |

Controlling the Narrative and Distribution Channels

- Shift to Direct-to-Consumer (DTC): Prioritize owned channels to control the entire client experience. The reason is that DTC platforms allow you to curate storytelling, unboxing, and CRM. This gives you end-to-end control over how your brand is perceived.

- The “Hermès Game”: Architect a system of access based on client relationships. This is achieved by tiering clients by lifetime spend. You should then grant high-value clients exclusive access to pre-launch invites, private studio visits, and custom-design options.

- Rigorous Vetting of Wholesale Partners: Never partner with a retailer who cannot uphold your brand standards. You must approve only top-tier retailers with bespoke in-store design, expertly trained staff, and strict MAP policy enforcement to preserve your brand’s aura.

- The Art of Storytelling: Use digital content to communicate the value embedded in your products. Immersive videos and artisan interviews that spotlight a 40-step hand-finishing process or a material’s provenance are not marketing fluff; they are tools for value justification.

Translating Physical Scarcity into the Digital Realm

- Building Digital Relatability: Use social media for storytelling, not just selling. Share behind-the-scenes clips of craftsmanship and client testimonials. Critical Warning: Limit product-centric “buy now” posts, as they can cheapen your brand. Use posts primarily to tease upcoming drops.

- Creating “Money-Can’t-Buy” Digital Experiences: Offer exclusive access to content and communities. Host virtual ateliers, invite-only live Q&As with your head artisans, or provide AR try-on previews for loyalty members to build a sense of an inner circle.

- Exploring Digital Assets and AI: Use new technology to create modern forms of uniqueness. You can launch NFT certificates of authenticity tied to physical limited-edition frames or use AI to recommend bespoke colorways based on client profiles, creating a hyper-personalized experience.

The Manufacturing Blueprint: Vetting a Partner to Execute Your Vision

Your brand strategy is worthless without a manufacturing partner who can execute it. Your vetting process must be ruthless and data-driven.

Evaluating a Partner’s Capacity for Scalable Craftsmanship

- Audit for Meticulous Quality Control: Demand documented QC checkpoints for every batch. This includes raw-material G-code validation for acetate, optical-grade lens scratch-resistance testing, and ISO-aligned final assembly audits. A partner without this documentation is a liability.

- Assess Technology and Hand-Finishing Integration: Verify that a supplier can balance automation for precision with essential artisanal processes. You must analyze their ability to pilot additive manufacturing alongside traditional hand-polishing stations. Key Metric: Ask for cycle times and defect-rate data under load.

- Mandate Pilot Runs and Phased Roll-Outs: Never go from zero to full-scale production. Require a low-volume pilot run (e.g., 100 units) with full process documentation. Only then should you scale via phased roll-outs of 500, 1,000, and 5,000 units to validate quality standards.

- Evaluate Flexible, Agile Production: Your partner must be able to switch to short runs for limited editions. Inspect their changeover times between SKUs. You need a partner who can execute a new color or material switch in under two days to support a capsule collection strategy.

Auditing the Supply Chain for Robustness and Integrity

- Demand Full Material Traceability: You must secure the provenance of your premium materials. Require chain-of-custody certificates and blockchain-enabled logs for every batch of critical materials like Mazzucchelli acetate or Japanese titanium.

- Assess Supply Chain Redundancy: A single-source supplier is a critical point of failure. Confirm that your partner has dual sourcing for key components and documented contingency plans to mitigate geopolitical, environmental, or logistical risks that could disrupt key launches.

- Verify ESG Compliance: Turn sustainability into a pillar of brand exclusivity. Audit their certifications (e.g., FSC for wood, REACH for chemicals) and review their annual sustainability impact reports. This is no longer optional; it is a core part of luxury storytelling.

Eyewear Industry Case Study: Licensing vs. Vertical Integration

Choosing a production model has profound implications for brand control.

| Production Model | Core Strength | Critical Drawback |

| Licensing (e.g., EssilorLuxottica) | Access to vast production capacity and a broad, established distribution network. | Reduced direct control over quality, storytelling, and distribution; high risk of brand variance. |

| Vertical Integration (e.g., Kering Eyewear) | Full brand oversight from design to manufacturing, ensuring consistent heritage and quality execution. | Higher initial CapEx investment and a slower ramp-up to achieve scale. |

Pro Tips: For brands prioritizing absolute control over their narrative and quality, a vertically integrated partner or a dedicated, high-touch manufacturer like Kssmi offers a superior model to mass licensing.

Conclusion

Successfully scaling production while preserving exclusivity is not a matter of compromise, but of discipline. It requires a rigorous brand strategy built on controlled scarcity models and a meticulously vetted manufacturing partner. Collaborating with an expert supplier capable of pilot-run proficiency, agile craftsmanship, and transparent supply-chain practices is the only way to achieve your growth objectives without sacrificing the brand equity you worked so hard to build.

The Bottom Line: Engage now in a strategic consultation to tailor a production blueprint that balances controlled volume increases with strict brand-equity preservation.

Frequently Asked Questions

1. What is the ideal ratio of core to limited-edition products?

A healthy ratio is typically 80% core collection products that drive consistent revenue and 20% limited-edition or capsule pieces. This mix provides commercial velocity while generating the “brand heat” and desirability needed to elevate the entire line.

2. How can a brand measure the dilution of its exclusivity?

Monitor leading indicators like a decline in full-price sell-through rates, an increase in gray market activity, and negative sentiment on social media. Also, track the purchase frequency of your top 5% of VICs; a decline is a major red flag.

3. What clauses must be in a manufacturing agreement for quality?

Your agreement must specify AQL (Acceptable Quality Limit) standards for every production run, mandated pilot runs for new SKUs, and the right to conduct on-site third-party audits. Also, include clauses that define material traceability requirements and penalties for non-compliance.

4. What are the critical challenges when moving to a third-party manufacturer?

The biggest challenges are transferring tacit knowledge from your in-house team and aligning on quality standards. You must over-communicate, create detailed technical packs for every SKU, and have your team on-site during the first production runs to prevent operational drift.

5. How does an exclusivity strategy differ across channels?

For physical retail, focus on in-store experience and clienteling. For e-commerce, use your DTC platform for storytelling and controlled access. On social media, the goal is desire-building through behind-the-scenes content, not direct selling, to maintain an aura of unavailability