True Cost of Manufacturing Acetate Sunglasses: A Unit Economics Breakdown

The manufacturing cost of premium acetate sunglasses is typically $15-$50 per unit at the factory. This cost breaks down into direct materials like acetate and lenses (40-50%), skilled labor (25-35%), factory overhead (15-20%), and quality control (5-10%). Your final landed cost, including shipping and duties, will range from $24-$51 per unit, forming the basis for your pricing strategy.

Strategic Foundations: The Business Case for Acetate

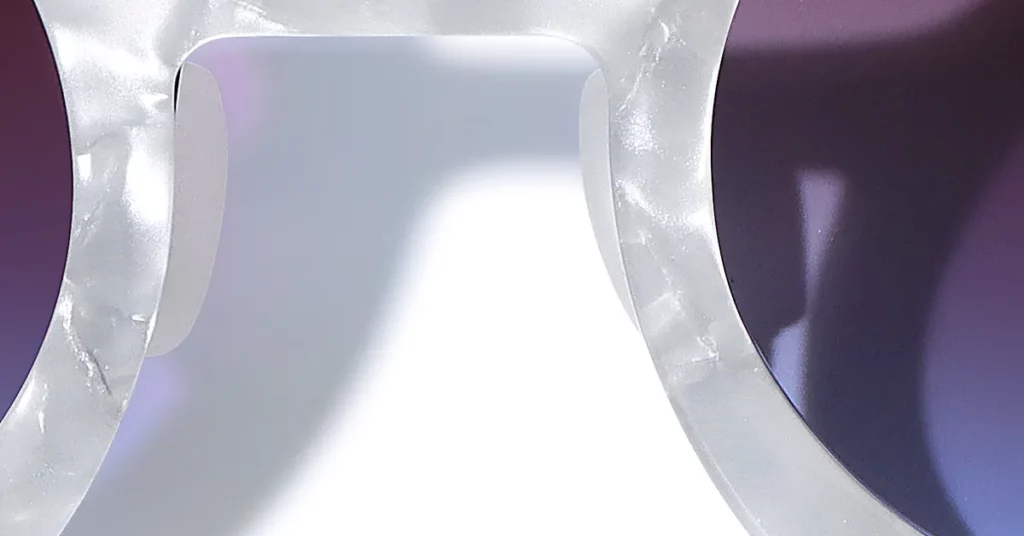

You must view material selection not as a simple line item, but as the foundational decision for your entire business model. Acetate is the material of choice for premium eyewear because it possesses a unique combination of performance, customization, and luxury aesthetics. Unlike injection-molded plastics, this allows you to justify the premium pricing essential for market leadership.

Why Acetate Justifies a Higher Margin

The selection of acetate is a strategic investment. The Bottom Line: Acetate’s premium positioning allows for 200-400% higher retail margins compared to standard plastic frames. This makes the additional material cost a calculated investment in profitability, not a simple expense. The material’s physical properties directly create market value.

- Hypoallergenic Nature: Acetate is biocompatible, which means you avoid customer complaints and returns related to skin sensitivity. This directly reduces your warranty and return costs by an estimated 15-25% compared to some metal alternatives.

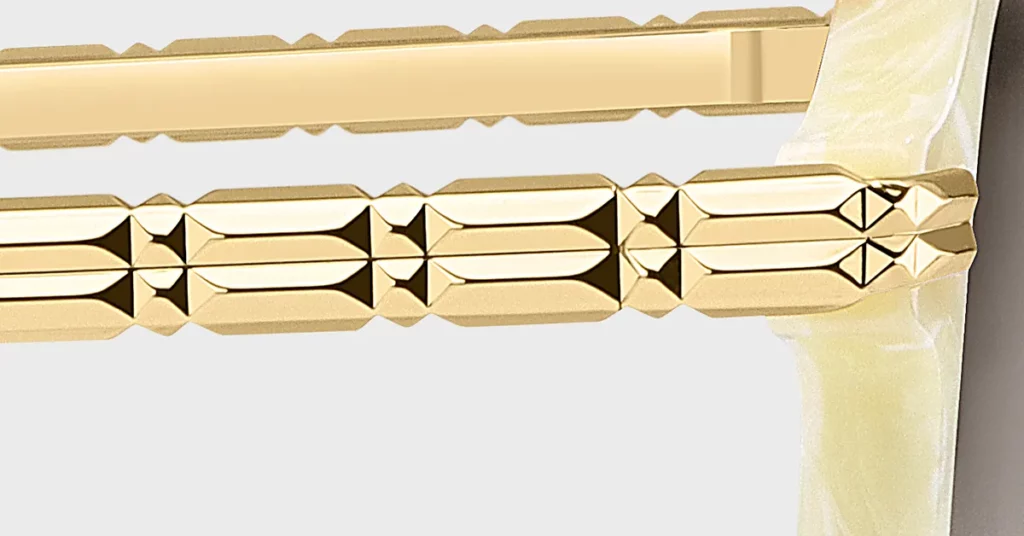

- Tactile Feel: The material’s natural warmth and substantial weight create an immediate perception of quality. This tactile experience is a key driver that enables brands to command prices 150-300% higher than comparable plastic frames.

- Lustrous Polish: The ability to achieve a deep, lustrous polish through hand-finishing provides an aesthetic richness that injection molding cannot replicate. This visual quality reinforces the premium positioning of your brand.

Key Metric: Premium acetate frames achieve customer satisfaction scores 20-30% higher than standard plastic frames. This satisfaction directly correlates with reduced return rates and increased customer lifetime value, validating the upfront investment.

The Inherent Cost of Quality

Acetate’s superior quality stems from a complex, time-intensive manufacturing process. For example, acetate blocks require extended curing times of 5-7 days at controlled temperatures. This process increases your manufacturing lead time and working capital requirements, but it delivers superior durability that reduces long-term warranty claims and elevates brand reputation.

The proprietary color blending required for premium patterns adds $2-$8 per frame in material costs. For Example: Italian acetate manufacturers like Mazzucchelli command this premium because their sophisticated color techniques create unique aesthetic differentiation. This visual signature is precisely what allows you to build a defensible brand identity.

Best Practice: You must factor the typical 32-day production cycle for handmade acetate frames into your inventory planning. This foresight is critical to avoid stockouts while maintaining optimal working capital efficiency.

Comparative Value: Handmade Acetate vs. Injection Molding

Handmade acetate production involves 40-60 individual manufacturing steps. This is a stark contrast to the 10-15 steps for mass-market injection molding. This complexity increases labor costs by 300-500%, but it creates a product with distinct character and superior quality that commands a premium market position.

| Manufacturing Method | Production Steps | Labor Cost Multiplier | Material Waste | Durability Factor | Premium Pricing Potential |

| Handmade Acetate | 40-60 | 4-5x | 15-20% | 1.5-2x | 200-400% |

| Injection Molding | 10-15 | 1x | 25-30% | 1x | 50-100% |

Pro Tips: The investment in handmade processes generates measurable returns. You benefit from 15-20% lower material waste than injection molding and a 40-60% longer product lifespan. These are powerful value propositions to communicate to your customers.

The Sustainability Angle: Standard vs. Bio-Acetate

Bio-acetate materials command a 20-40% cost premium over standard acetate. This translates to an additional material cost of $3-$7 per frame. However, this investment grants your brand access to the rapidly growing sustainable eyewear market, justifying 50-100% higher retail prices among eco-conscious consumers. Brands emphasizing sustainability can achieve 25-35% higher gross margins despite the increased material cost.

Manufacturing Method and Cost Structure

Your choice between handmade and automated production is a fundamental decision that dictates your entire cost structure. Handmade acetate production demands skilled artisans and extended production times. This increases your unit costs but is essential for the premium market positioning you seek.

CNC Milling and Hand-Finishing

Computer Numerical Control (CNC) milling represents the optimal balance between precision and efficiency in acetate frame production. The machine investment of $100,000-$250,000 is amortized across production volumes. This technology reduces per-unit costs over time while maintaining critical quality consistency.

Hand-finishing processes, however, add $3-$8 per frame in direct labor costs. This is because the skilled labor required for hand-polishing and final assembly commands wages 150-200% higher than standard manufacturing labor. This human touch creates the tactile quality and aesthetic refinement that differentiates a premium product.

Critical Warning: Underestimating the skilled labor requirements for acetate production is a common and costly mistake. Attempting to save on labor will lead to quality issues and production delays that erase any perceived cost savings.

Tooling Costs vs. Variable Costs

There is an inverse relationship between tooling and variable costs that you must understand.

- Handmade Production: This method requires minimal upfront tooling investment ($5,000-$15,000 per style). However, it comes with higher per-unit variable costs due to the reliance on skilled labor. This cost structure is ideal for the low-volume, high-margin strategies of premium and luxury brands.

- Automated Production: This method demands significant upfront tooling investment ($20,000-$50,000 per style). In exchange, it achieves lower variable costs through economies of scale. The break-even point typically occurs at 2,000-5,000 units per style, making it suitable for mass-market positioning only.

How Minimum Order Quantities (MOQs) Mitigate Risk

Manufacturers use Minimum Order Quantities (MOQs) to amortize their setup costs and ensure production line efficiency. For handmade acetate, you should expect MOQs from 300-1,000 units per style. For automated production, this number increases to 1,500-5,000 units. Understanding this allows you to strategically plan your inventory investment and manage cash flow.

Deconstructing the Bill of Materials (BOM)

A bottom-up analysis of your direct costs begins with the Bill of Materials. Every component, from the acetate itself to the smallest screw, has a financial implication.

The Core Material: Cellulose Acetate Costs

Cellulose acetate represents 40-60% of the total direct material cost. The quality and origin of the acetate you choose directly impact both your manufacturing cost and your brand’s market position.

| Acetate Origin | Cost per Sheet | Quality Rating | Brand Positioning Value | Typical Applications |

| Italian (Mazzucchelli) | $12 – $25 | Premium | Luxury / Designer | High-end fashion & heritage brands |

| Japanese | $8 – $15 | High | Premium / Performance | Quality-focused & technical brands |

| Chinese | $4 – $8 | Standard | Value / Mass Market | Cost-sensitive & entry-level brands |

Pro Tips: The material cost difference of $3-$8 per frame between Chinese and Italian acetate is not an expense; it’s an investment. Luxury brands leverage the provenance of Italian acetate to build a brand narrative that justifies a 10-20x return on that incremental cost at retail.

Technical specifications also act as cost multipliers. Standard acetate sheets are 6mm for the front and 4mm for the temples. Requesting custom thicknesses can increase material costs by 15-30%. Similarly, complex laminated patterns can add $2-$5 per frame but enable unique aesthetic differentiation.

Key Metric: Acetate utilization rates typically range from 60-75%. This means a significant portion of the material becomes waste. Optimizing your cutting patterns to achieve 75-80% material utilization can reduce your material costs by 10-15% without compromising design.

Optical Components: The Variable Cost of Lenses

Your choice of lenses significantly impacts your cost structure and customer value proposition.

| Lens Material | Cost Per Pair | Key Benefit | Ideal Segment |

| CR-39 | $3 – $6 | Excellent Optical Clarity | Basic & Fashion |

| Polycarbonate | $6 – $12 | High Impact Resistance | Active & Children’s |

| Trivex | $12 – $20 | Superior Optics & Impact Resistance | Performance & Premium |

Performance treatments are additive costs you must factor in. Anti-reflective coatings add $2-$5 per pair, while polarization increases costs by $5-$12 per pair. Photochromic lenses add $15-$25 per pair, but they create highly differentiated products that can justify 200-300% higher retail prices.

Hardware and Finishing Components

The quality of your hardware has a disproportionate impact on perceived brand quality.

- Hinges: Standard 3-barrel hinges cost $0.50-$1.50 per frame. Upgrading to premium 5-barrel hinges increases costs to $2-$4 per frame but delivers enhanced durability. Custom spring systems can add $3-$8 per frame but provide a tangible comfort benefit.

- Sundry Parts: High-quality screws, core wires, and rivets add $1-$3 per frame. Skimping here is a critical error, as hardware failure can severely damage brand reputation.

- Consumables: Often overlooked, polishing media, compounds, and branding inks cost $0.25-$0.65 per frame. In high-volume operations, these costs can accumulate to 5-10% of your total production cost.

Quantifying Labor, Overhead, and Quality

Labor is the largest variable cost in handmade acetate production, accounting for 25-35% of your total manufacturing cost. Understanding the drivers of labor costs is essential for effective margin optimization.

Calculating the Cost of Artisanship

A skilled CNC technician earns $15-$25 per hour, with each frame requiring 15-25 minutes of machine time. Hand-finishing artisans earn $12-$20 per hour and may spend 30-45 minutes polishing and assembling a single frame.

Key Metric: The total labor time per frame ranges from 45 to 90 minutes. This translates to a direct labor cost of $8-$25 per frame, depending heavily on the manufacturing region and the complexity of the design.

| Manufacturing Region | Hourly Labor Rate | Estimated Labor Cost per Frame | Implication |

| Western Europe | $20 – $35 | $15 – $25 | “Made in Europe” branding, proximity to luxury markets |

| Eastern Europe | $12 – $18 | $8 – $15 | Balance of quality and value, skilled workforce |

| China (Tier 1 City) | $8 – $12 | $6 – $10 | Competitive pricing with high quality standards |

| China (Tier 2 City) | $5 – $8 | $4 – $7 | Cost-focused production for mass-market segments |

Best Practice: You must balance design complexity with production efficiency. A complex frame can require up to 120 minutes of labor, directly impacting your production throughput and unit economics. Optimize your product mix to ensure adequate margins across all SKUs.

Allocating Indirect Costs

Overhead costs typically represent 15-25% of total manufacturing costs and must be accurately allocated to understand your true unit economics. This includes per-unit allocations for rent, utilities, and machinery depreciation. Furthermore, you must amortize upfront investments like design and prototyping ($2,000-$8,000 per style) and production jigs ($1,000-$3,000 per style) across the planned production volume.

The Cost of Quality Control

Quality control (QC) adds 5-10% to your manufacturing cost, but this is an investment, not an expense. The cost of a recall or brand damage can be 100x the prevention cost. A dedicated QC team and inspection equipment will add $0.50-$1.50 per frame to your expenses.

Key Metric: Typical rejection rates for handmade acetate frames range from 3-8%. Superior process control can reduce this to 2-5%. You must also budget for third-party lab testing to meet standards like ANSI Z87.1+ and EN ISO 12312-1, which costs $500-$2,000 per style.

From Cost to Profit: Building Your Financial Model

Understanding every component cost allows you to establish your true landed cost—the final number before any margin is applied.

Synthesizing the Cost of Goods Sold (COGS)

A comprehensive analysis reveals a typical cost structure for premium handmade acetate sunglasses:

- Materials: $8 – $18 per frame (40-50%)

- Labor: $8 – $15 per frame (25-35%)

- Overhead: $4 – $8 per frame (15-20%)

- Quality Control: $1 – $3 per frame (5-10%)

- Total Manufacturing Cost: $21 – $44 per frame

To find your landed cost, you must add “last mile” costs. Packaging adds $0.50-$2.00 per frame, international freight adds $1-$3, and insurance and customs duties contribute another $1-$2.

The Bottom Line: Your total landed cost will typically range from $24 to $51 per frame. This is the foundational number for your entire pricing strategy.

Architecting a Profitable Pricing Strategy

With a clear landed cost, you can architect a pricing model that ensures profitability.

- Wholesale Markup (B2B): A standard wholesale markup is 2.2x to 3.5x your landed cost. This results in a wholesale price of $53-$178 per frame. This markup must cover your distribution costs, sales commissions, marketing, and profit margin.

- Retail Markup (MSRP): The Manufacturer’s Suggested Retail Price (MSRP) is typically a 2.5x to 4.0x markup on the wholesale price. This results in an MSRP range of $133-$712.

Your position within the market’s pricing spectrum will depend on your brand equity.

- Value Segment: $50 – $150 MSRP (3-5x production cost)

- Premium Segment: $150 – $400 MSRP (5-10x production cost)

- Luxury Segment: $400+ MSRP (10-20x production cost)

Strategic Supplier Vetting

Use your knowledge of unit economics to select the right manufacturing partner. Demand transparency to deconstruct a manufacturer’s quote and verify their claims.

The Open Cost Sheet

The Open Cost Sheet is a critical tool. Demand a detailed breakdown that includes material costs with supplier names, labor rates, overhead allocation, and tooling amortization.

Critical Warning: A quote that is significantly below market rates is a major red flag. It often indicates hidden costs, quality compromises, or unrealistic assumptions that will lead to production failures. Watch for vague cost categories, unusually low labor rates, or missing QC costs.

When comparing quotes, you must normalize them for regional differences in labor, material availability, and quality levels. Assess a partner’s capabilities beyond the price tag. Match factory expertise to your product’s complexity to avoid costly errors. Always demand material certifications to verify the source and grade of the acetate.

Conclusion

Mastering the unit economics of acetate sunglasses is not an academic exercise; it is a prerequisite for survival and growth. A granular understanding of materials, labor, and overhead enables you to build a resilient financial model, negotiate effectively, and price your products for sustainable profit. Partner with a manufacturing expert who provides total cost transparency, as this clarity is the foundation upon which a market-leading eyewear brand is built.

Frequently Asked Questions

1. How should I amortize costs for limited vs. core products?

For seasonal frames, amortize tooling over the short run (500-1,500 units), resulting in a higher per-unit allocation. For core products, amortize over larger volumes (2,000-5,000+ units) across seasons for a lower per-unit cost.

2. What is the most overlooked cost in a Bill of Materials?

Consumables like polishing compounds, cleaning agents, and printing inks are most often overlooked. These can add $0.50-$1.50 per frame, eroding margins by 5-10% if not properly accounted for.

3. What causes the cost difference between Italian & Chinese factories?

Labor rates account for 60-70% of the cost difference. Sourcing premium European components like brand-name acetate and hinges contributes another 20-30%, with overhead making up the rest.

4. Which QC checkpoint has the biggest impact on unit cost?

The post-CNC machining inspection has the highest impact, catching 3-8% of defects. Rigorous inspection here, along with pre-assembly and post-tumbling checks, is critical for reducing costly rejection rates.

5. How can I verify a manufacturer’s “bio-acetate” claims?

Demand to see supplier certifications and material origin documents. The typical cost premium for bio-acetate is 20-40% over standard acetate, or an additional $3-$7 per frame.