White Label vs. Private Label Sunglasses from China Which is Right for Your Brand?

For B2B buyers, the decision hinges on a core trade-off: White label (WL) manufacturing offers speed and low capital entry by rebranding factory-owned designs, enabling launches in under 30 days. Private label (PL) manufacturing provides true product exclusivity and higher ROI through brand-owned designs, but demands tooling investments and 90- to 180-day development cycles. This guide provides the definitive framework for choosing the correct path for your brand.

The Core Strategic Decision: WL vs. PL Defined

White label and private label are fundamentally different business models. You must understand that WL sourcing means you are renting a factory’s existing design, while PL means you are commissioning the creation of a proprietary asset. The strategic implications of this distinction are immense.

| Attribute | White Label (WL) | Private Label (PL) |

| Core Concept | Select and rebrand existing, factory-owned sunglass designs (“off-the-shelf”). | Commission the creation of a unique, proprietary design based on your brand’s specifications. |

| Design Ownership (IP) | The factory retains 100% ownership of the mold, design, and tooling. | Your brand owns the intellectual property, including CAD files and the physical mold. |

| Market Exclusivity | None. The same frame shape can be, and often is, sold to competing brands. | Absolute. You are the only brand with access to the design, creating a defensible market position. |

| Ideal Use Case | Rapid market entry, testing new trends, seasonal collections, validating product-market fit. | Building a core collection, establishing brand DNA, creating a premium or luxury product line. |

| Governing Model | Aligns with Original Design Manufacturing (ODM), where the factory provides the core design. | Aligns with Original Equipment Manufacturing (OEM), where you provide the design for the factory to produce. |

Definition: The distinction between OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) is critical. For a private label project, you operate as the OEM, supplying the designs for the factory to build. For a white label project, the factory is the ODM, and you are simply customizing the “trim” (logos, colors) on their pre-existing product.

Analyzing the Strategic Trade-Offs for Your Business

A clear-eyed assessment of differentiation, exclusivity, launch velocity, and IP ownership is mandatory before you issue a purchase order. Your choice here directly impacts your brand’s competitive posture and financial trajectory.

| Strategic Factor | White Label Impact | Private Label Impact |

| Brand Differentiation | Observation: You are selling a silhouette shared by multiple competitors. Implication: This forces you to compete primarily on price or minor logo variations. Outcome: Sustaining a premium price point is nearly impossible, leading to margin compression. | Observation: You control a unique and exclusive frame shape. Implication: This enables brand storytelling around design, materials, or artisanal finishes. Outcome: You can insulate your product from direct price comparison, justifying a premium MSRP. |

| Market Exclusivity | Observation: WL products carry an immediate market saturation risk. Implication: Competitors can quickly list the same product on platforms like Amazon or T-Mall. Outcome: This invites race-to-the-bottom pricing, destroying profitability and brand perception. | Observation: PL investment creates a defensible moat around your product. Implication: Your design cannot be legally copied, allowing for strict MAP policy enforcement. Outcome: Retailer confidence is higher, and you maintain control over your pricing structure. |

| Speed-to-Market | Observation: Production leverages existing molds and supply chains. Implication: Lead times, including logo printing and packing, are just 15–30 days. Outcome: You can react instantly to market trends and replenish stock for viral hits with minimal delay. | Observation: New product development requires a multi-stage process. Implication: Lead times average 90–180 days (CAD, sampling, mold cutting, pilot run). Outcome: Your planning cycle is longer, demanding accurate forecasting and a patient capital strategy. |

| Intellectual Property | Observation: The design is an asset of the manufacturer. Implication: You have no legal claim to the shape or construction. Outcome: You cannot register design patents or build tangible IP assets, which lowers enterprise valuation for investors. | Observation: The design is a brand-owned asset. Implication: You can file for design patents and utility models in your key markets. Outcome: You build a portfolio of defensible IP, which is a critical driver of long-term brand equity and valuation. |

The Financial Blueprint: Investment, Costs, and ROI

You must deconstruct the full cost of each model to protect your margins. Understanding every expense line—from tooling and unit costs to quality control and prototyping—is non-negotiable for building a profitable eyewear program.

| Financial Component | White Label (WL) | Private Label (PL) |

| Up-front Capital (Capex) | $0 in tooling costs. The only initial expense is the inventory purchase. | $6,000–$25,000 per style. This includes mold costs ($1k-$15k) and CAD/prototype fees ($300-$800). |

| Average Unit Cost (COGS) | $2.30–$7.00 for PC/TR90 frames. $8–$18 for standard acetate with UV400 TAC lenses. | $3.50–$6.00 for custom color PC/TR90. $12–$18 for custom acetate. $18–$25 for β-Titanium. |

| Minimum Order Quantity (MOQ) | 100–300 pieces per colorway, offering high flexibility for testing. | 300–1,200 units per shape, requiring a significant inventory commitment. |

| Return on Investment (ROI) | Delivers rapid cash flow (typically within 45 days) but faces long-term margin decay. | Higher initial cash outlay with breakeven around 3,000 units, but enables premium MSRPs and builds lasting enterprise value. |

Pro Tips: Your total cost of ownership must include variable expenses. Always budget an additional $280–$450 for a factory audit, $180 for inline quality control inspections, and $300 for a final pre-shipment inspection based on AQL standards. Private label projects will also incur minor costs for color-drawdown samples and advanced lens testing.

The Partnership Playbook: Vetting High-Capability Manufacturers

Your chosen factory is not a supplier; it is a strategic partner whose capabilities directly determine your product’s quality and your brand’s reputation. You must conduct rigorous due diligence.

Establish Critical Evaluation Criteria

- Prioritize specialists. Target the Wenzhou and Shenzhen industrial clusters for acetate expertise; look to Xiamen and Dongguan for high-precision injection molding. A factory claiming to master all materials is a red flag.

- Demand proof of in-house operations. A vertically integrated partner with in-house CNC machining, plating, and tumble-polishing reduces lead times and protects your intellectual property. Request floor videos and a full equipment list as proof.

Verify Quality and Compliance

- Confirm QMS certification. A current ISO 9001:2015 certificate is non-negotiable. It demonstrates the factory has documented standard operating procedures (SOPs), which directly translates to lower defect rates.

- Mandate safety standard reports. You must request recent test reports for EN ISO 12312-1 and ANSI Z80.3. These reports are your only guarantee of compliance with international standards for UV protection, impact resistance, and nickel release.

Build a Resilient Partnership

- Critical Warning: Never send CAD files or proprietary data before executing a China-enforceable NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement. This agreement must be written in Chinese and governed by Chinese law to be effective.

- Clarify mold ownership explicitly. Your private label manufacturing agreement must state that all molds and tooling are the exclusive assets of your brand. The contract should specify that they are stored on-site by the factory but are transferrable to another facility upon your demand.

- Best Practice: Define your quality assurance protocols in the manufacturing agreement. Specify an AQL (Acceptance Quality Limit) of 1.5/4.0 for critical and major defects, and mandate 100% drop-ball testing for all lenses to ensure impact resistance.

Decision Matrix: Aligning a Model to Your Business

The right choice is entirely dependent on your business archetype. A startup’s optimal path is a luxury brand’s critical failure.

For E-commerce Startups & Fast-Fashion Brands

The Assertion: White label is the superior tool for market entry and product validation.

The Rationale: WL sourcing removes the significant friction of R&D and tooling capital expenditure. This allows you to rapidly test dozens of shapes and identify viral trends from platforms like TikTok.

The Action/Benefit: Use WL to launch with low sunk costs, gather real-world sell-through data, and achieve 15-day replenishment cycles to capitalize on winning styles without massive inventory risk.

For Luxury, Designer, and Optical Brands

The Assertion: Private label is non-negotiable for translating brand DNA into a unique, premium product.

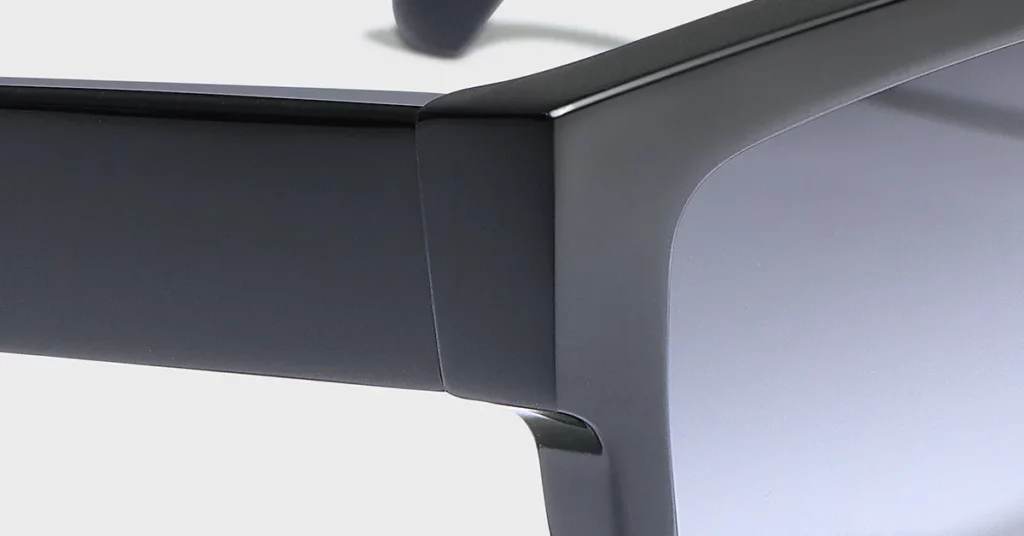

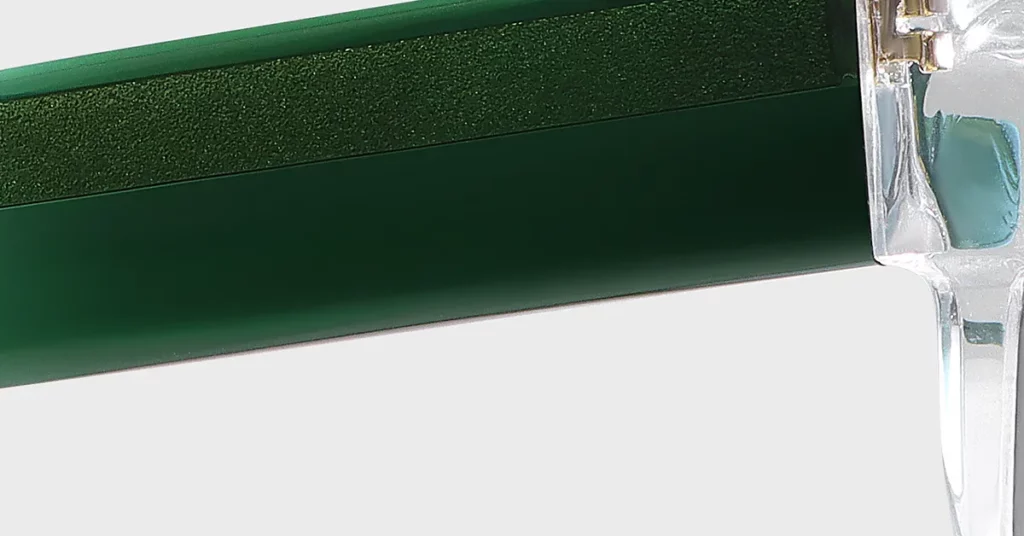

The Rationale: A luxury consumer expects and pays for tangible uniqueness—bespoke temple core engravings, layered acetate fades, or signature hinge mechanisms. These features are only achievable through a proprietary PL process.

The Action/Benefit: Invest in a PL strategy to create a product that is impossible to comparison-shop. This exclusivity is what justifies a premium price point, builds a defensible competitive moat, and maintains gross margins above 70%.

The Advanced Hybrid Strategy: A Pathway to Scalable Growth

For many brands, the optimal long-term strategy is not a permanent choice but a phased approach that leverages the strengths of both models.

- Phase 1: Market Validation with White Label. Launch a curated collection of 3–5 WL models. Focus on gathering sell-through data to identify your winning silhouettes, colorways, and lens tints with minimal financial exposure.

- Phase 2: Strategic Investment in Private Label. Analyze the performance data from your WL program. Confidently invest your tooling budget into creating proprietary versions of your proven top-performers, upgrading materials to bio-acetate or specifying premium Zeiss lenses to lock in your market position.

Conclusion

The decision between white label and private label manufacturing is a foundational choice that will shape your brand identity, risk profile, and competitive advantage for years. White label is a powerful tool for accelerating cash flow and validating market hypotheses. Private label is the mandatory path for cementing premium positioning, building defensible brand equity, and maximizing long-term enterprise value. Kssmi is an expert partner in both disciplines, guiding brands from rapid WL launches to meticulously engineered PL collections.

Frequently Asked Questions

1. How can a brand effectively protect its designs in China?

Register your design patents in your primary sales markets. You must also execute a China-enforceable NNN agreement before sharing any data and include clear IP ownership clauses in your manufacturing contract.

2. What are the critical specs for a private label tech pack?

A complete tech pack must include 1:1 scale CAD drawings, specific acetate color codes, lens base curve and material, the exact hinge model number, a complete tolerance chart (e.g., ±0.15 mm for eye-size), and Pantone codes for all logos and markings.

3. What is the typical mold cost for acetate vs. metal frames?

An acetate CNC mold typically costs $1,000–$3,000. A metal or titanium pressing mold is more complex and costs $4,000–$6,000 because it often requires multi-slide tooling for intricate parts.

4. How do I transition from a white label to a private label model?

After identifying a winning WL style through 1–2 reorder cycles, brief your factory with the performance data. The typical timeline is 2 weeks to approve a new CAD, 4 weeks to receive a prototype, and 90–120 days to launch the new PL version.

5. What advanced lens quality tests should I require?

Demand reports confirming compliance with EN ISO 12312-1 for spectral transmission. You must also require the ANSI Z80.3 drop-ball test for impact resistance, a haze measurement showing less than 3% light scatter for optical clarity, and a Bayer abrasion test result of 4 or higher.